Parker soon lost control of his own meeting.

Protesters briefly took over the bank's shareholders meeting, which was held Tuesday at the Grand Hyatt DFW hotel inside Dallas/Fort Worth International Airport, calling the bank a pack of frauds and criminals. One protester shouted that Wells Fargo, and Parker himself, couldn't be trusted.

One by one, protesters stood up and heckled Parker as he pleaded with them to sit down and save their comments for a question-and-answer session later in the meeting's agenda.

"One of the great things about shareholder democracy ..." Parker began several times before being cut off by yet another protester.

The demonstration was organized by the nonprofit housing advocacy group Neighborhood Assistance Corporation of America. The nonprofit has called on people to divest from Wells Fargo, calling it "the largest and most corrupt financial institution."

Wells Fargo has been under fire since 2016, when it was revealed that its employees opened fraudulent accounts in customers' names without their knowledge. Later that year, the company was fined $190 million to settle the case. Then last year, the company paid $1 billion to settle a case in which it was accused of charging hundreds of thousands of customers for auto insurance they didn't need and hadn't ordered. Last month, the bank's CEO, Tim Sloan, stepped down, becoming the second chief executive to resign since the scandal broke.

The bank's 2017 and 2018 shareholders meetings were also punctuated by angry outbursts from members of the housing advocacy nonprofit and others.

"I'm a very hard-working person. And this is what I get from the bank that I trusted." – Niameh Freeman

tweet this

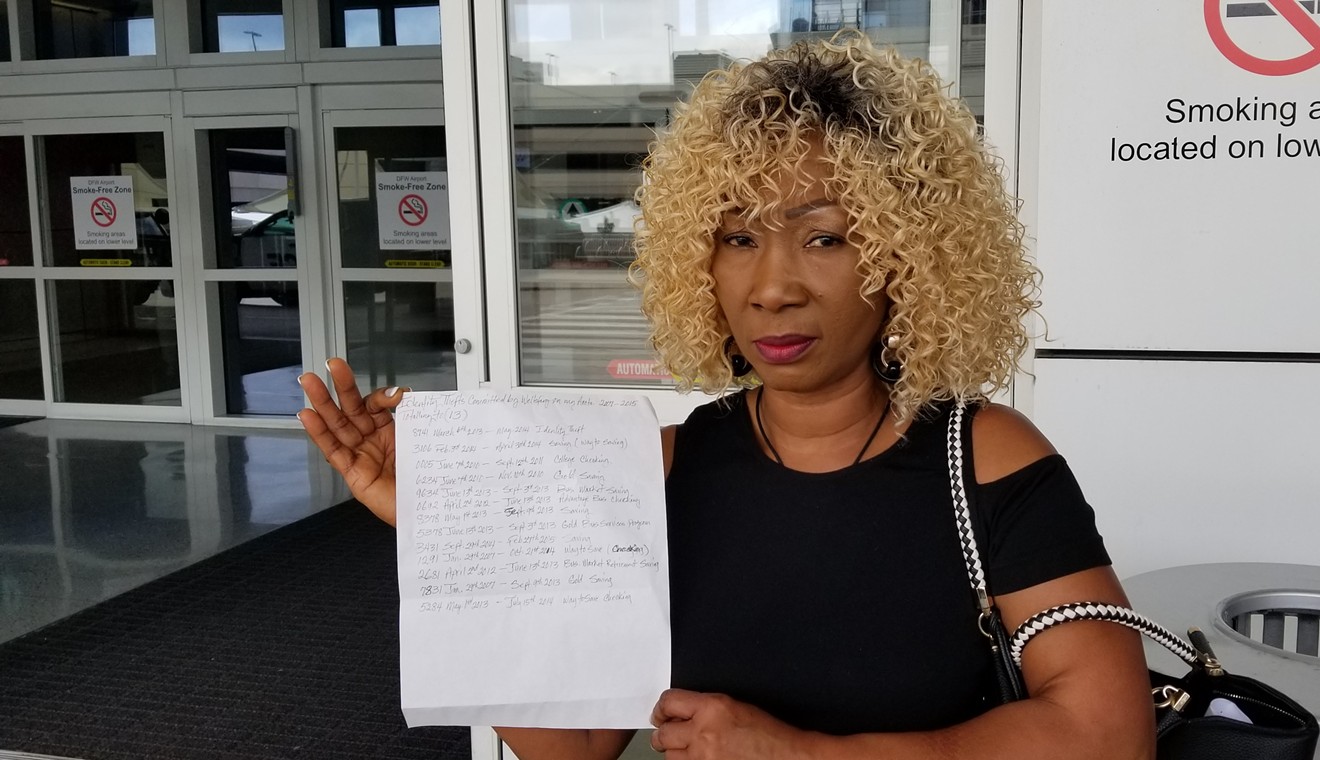

One of the protesters at Tuesday's meeting was Niameh Freeman, a salon owner in Euless. During the meeting, Freeman tried to tell Parker about how, between 2007 and 2015, his company opened 13 bank accounts in her name, without her knowledge. Freeman said she remained a loyal Wells Fargo customer, even after she learned about the fraudulent accounts, until the bank closed her account earlier this year.

As Freeman spoke, security guards surrounded her and began moving her out the door. As guards pushed Freeman into the hallway outside the conference room, she shouted tearfully at Parker that she'd been a loyal Wells Fargo customer for 20 years.

"Twenty years!" she could be heard shouting from the hallway as guards took her up two escalators and out of the airport terminal's front doors.

After she was thrown out of the meeting, Freeman told the Observer that she fled to the United States from her native Liberia during the Liberian civil war. She settled in Texas, opened a salon and raised her two daughters.

Freeman said the company ruined her credit when it opened those 13 fraudulent accounts in her name. The damage to her credit has caused problems for her business because it's made it more difficult for her to get a loan. Freeman said she's angry that Wells Fargo preyed on her and thousands of others like her.

"I came to this country because this is a land of freedom and a land of opportunity," she said. "I work hard. I'm self-employed. I try to do everything right. And I pay my taxes. And I'm a very hard-working person. And this is what I get from the bank that I trusted."

A few times during Tuesday's meeting, Parker seemed to try to acknowledge the protesters' grievances. When activist Bruce Marks, founder of Neighborhood Assistance Corporation of America, got up to speak, Parker said he'd be happy to speak with him and asked him to stay and discuss his concerns during the Q&A period.

"I know that you have substantive things to say," Parker said.

Erick Exum, the housing nonprofit's national director, said the group had about 50 people protesting inside the meeting and another 350 outside. The group's goal was to disrupt the meeting and force the bank and its shareholders to pay attention to the people who were harmed during the fraudulent account scandals.

"We're not going to wait our turn to speak, because the banks don't wait," he said. "They just go out there and grab, grab, grab."